A Guaranteed Way To Get A Mortgage From 1 of 130+ Banks and Lending Institutions Without The Hassles … Get Assigned To Your Personal Advocate. Select One Of The Conventional Mortgage Options Offered

One Of The Single Biggest Problems With Purchasing Real Estate Is ‘Cutting Cost’ and How To Find A Scenario Based - Conventional Mortgage Advocate That Assist With Conventional, Owner Occupied or Investor Focused Programs. Our Branch manager did something about this... with the Mortgage Generator.

Make a request, ask a question about a mortgage and real estate scenario.

Receive the solution and the money!

Types of Conventional Mortgages Offered

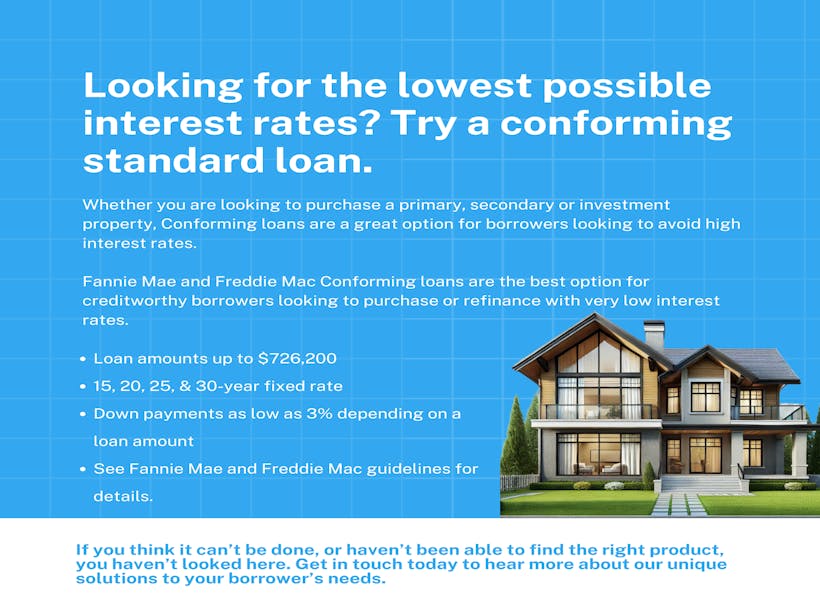

Conforming Loans:

Description: Follow guidelines set by the Federal Housing Finance Agency (FHFA) and Fannie Mae and Freddie Mac.

Loan Limits: Up to $766,550 in most counties, and up to $1,149,825 in high-cost counties.

Benefits: Standardized terms, flexible programs & competitive rates.

Jumbo Loans:

Non-conforming loans exceeding FHFA limits, often used for luxury homes.

Loan Amounts: Typically between $1–3 million.

Benefits: Ideal for high-value property purchases.

Non-Conforming Loans:

Loans that exceed FHFA limits or do not meet conventional guidelines.

Types Include: Loans for poor credit, minimal income documentation, and interest-only payments.

Benefits: Greater flexibility for unique financial situations.

Portfolio Loans:

Loans kept in the lender's portfolio rather than sold on the secondary market.

Benefits: Customizable terms and conditions, often more flexible approval criteria.

Conventional vs. Government Loan Programs An Educational Analysis

Conventional Loans:

Qualifications: Generally require higher credit scores and down payments compared to government loans.

Flexibility: More options for loan terms and structures.

Loan Limits: Can be higher with jumbo loans, suitable for high-value property purchases.

Private Mortgage Insurance (PMI): Required if the down payment is less than 20%, but can be canceled once equity reaches 20%.

Benefits of Conventional Mortgages for All Income Levels

For High Net Worth Individuals:

Higher Loan Amounts: Access to jumbo loans for purchasing luxury properties.

Flexible Terms: Customize loan terms to fit your financial strategy.

Competitive Rates: Benefit from lower interest rates with excellent credit and high-value loans.

Portfolio Diversification: Use mortgage solutions as part of a broader investment strategy.

For Low-Income Borrowers:

Flexible Options: Adjustable-rate and interest-only mortgages can provide lower initial payments.

Down Payment Assistance: Certain programs may offer support for down payments and closing costs.

Building Equity: Start building equity in a home, which can be a critical step towards financial stability.

Why Choose Us?

We pride ourselves on offering a buffet of extraordinary financial products tailored to your taste and needs. Our white-glove personal mortgage banking concierge service ensures you receive the highest level of care and attention even after the transaction, years down the line. Whether you're aiming for a high-value purchase or navigating the challenges of lower income, our expert advisors will guide you every step of the way.

Get Started Today

Take the first step towards securing your ideal mortgage solution. Contact us now to explore how our specialized mortgage and lending solutions can help you achieve your financial goals.

Schedule a free consultation or call us at 855-372-3066.

Or

Get Started Digitally Right Now.

[$LARGE AMOUNT]!

That’s how much I must’ve spent before finally working out how to [get/become/do] [ the thing people reading this letter most want to do].

But you can skip all the frustration.

You can side-step all the trial and error.

You can bypass all the heavy financial investment and sleepless nights wondering if you’ll ever find an answer that works.

I’ve done all that for you, and trust me, it’s no fun.

Especially, when you can avoid all of it for a one-time low price of just [$PRICE]

- Discover the Conventional Best Mortgage Solution for Your Unique Needs

View Our Types of Conventional Mortgages

- Multi-State, Daily Online Processing. Out The Box Scenario Non Traditional Funding Consulting

- In-house Realtoriginator with In-House Insurance Referral to 100+ Carriers

- Jumbo Mortgages, Versatile Conventional & Self Employed Options

- One week closings, digital customer service and processing.

After Today, You’ll Be Able To Get An Amazing Conventional Mortgage Program That Best Fits Your Purchase or Refinance Need. We can also help with other P.I.T.I reductions, like Insurance!

Welcome to your premier partner in homeownership and financial growth. Whether you’re purchasing your dream home or refinancing your existing mortgage, our diverse range of conventional mortgage solutions is designed to meet your specific needs.

Rashad Carmichael

Loan Officer Branch Manager| NMLS# 1453799

rcarmichael@amres.com | Daily Multi-State Call Centers Toll Free(855)372-3066

Amres Corporation | NMLS #1359704

(844)242-6656

1 Neshaminy Interplex Dr. Suite 310, Trevose PA, 19053

For licensing information, go to http://www.nmlsconsumeraccess.org

Toll -Free 855-372-3066